Navigating Residential Supervisory Locations and Remote Inspections: Compliance Strategies Webinar

OVERVIEW

- SUMMARY

A webinar hosted by Red Oak that focuses on helping financial firms navigate new FINRA regulations concerning Residential Supervisory Locations (RSLs) and remote inspections. The discussion features compliance experts who outline the requirements, challenges, and opportunities presented by these rules, specifically FINRA Rules 3110.19 and 3110.18. Speakers emphasize the need for firms to adopt a risk-based approach, update their supervisory procedures (WSPs), and potentially invest in compliance technology to manage these remote locations effectively. The webinar also includes a presentation from a compliance consultant who details a technology-integrated strategy for assessing risk and monitoring supervised persons across remote offices. Ultimately, the session underscores that while the new rules offer flexibility, firms must maintain stringent compliance standards to avoid regulatory penalties.

CRITICAL QUESTIONS POWERED BY RED OAK

Does the RSL program apply to RIAs or just broker-dealers?

The RSL (Residential Supervisory Location) rules are specific to broker-dealers. They do not apply to RIAs unless the firm is dually registered, in which case broker-dealer rules may still be enforced on the RIA side by firm policy.

If I’m a supervisor working from home only one day per week, do I still need to designate my location as an RSL?

Yes. There is no hybrid exemption. If you engage in any supervisory activities from your home, even once a week, FINRA expects you to designate the location appropriately—either as an RSL or a registered branch, depending on eligibility and state rules.

Can RSL inspections be conducted virtually if we’ve opted into the Remote Inspection Pilot Program?

Yes. If your firm has opted into FINRA’s Remote Inspection Pilot Program, you are allowed to conduct RSL inspections virtually. Otherwise, the default expectation is on-site inspections at RSL locations.

TRANSCRIPT (FOR THE ROBOTS)

Jamey Heinze And I think we're good. We are live. I'd like to welcome everybody to the next webinar that Red Oak has in our ongoing series of webinars just to share thought leadership with our community.

Jamey Heinze And I think we're good. We are live. I'd like to welcome everybody to the next webinar that Red Oak has in our ongoing series of webinars just to share thought leadership with our community.

This one, as you all know because you registered for it, is about navigating residential supervisory locations and remote inspections based on new regulations. So this is the strategy that will be imperative for everybody here as we move through 2025.

What we will cover today are again the RSLs and remote inspections and FINRA. We will then jump into what does this mean and what should we do? Which is the really important part for everybody here. We have a guest speaker who will cover her RSL strategy at a company where she is a CCO, and then we’ll talk about how Red Oak can help.

Let me introduce—oh, before I introduce the speakers, let me explain how to ask questions. At the bottom of the Zoom webinar window, you’ll see a Q&A button. It’s simple. Click on the button, submit questions as they come up. We’re going to save the questions until the end, but we will cover all that we can. If we run out of time, we’ll aggregate the questions, answer them, and send them back out to everyone so you’ll have a record of what you were interested in finding out.

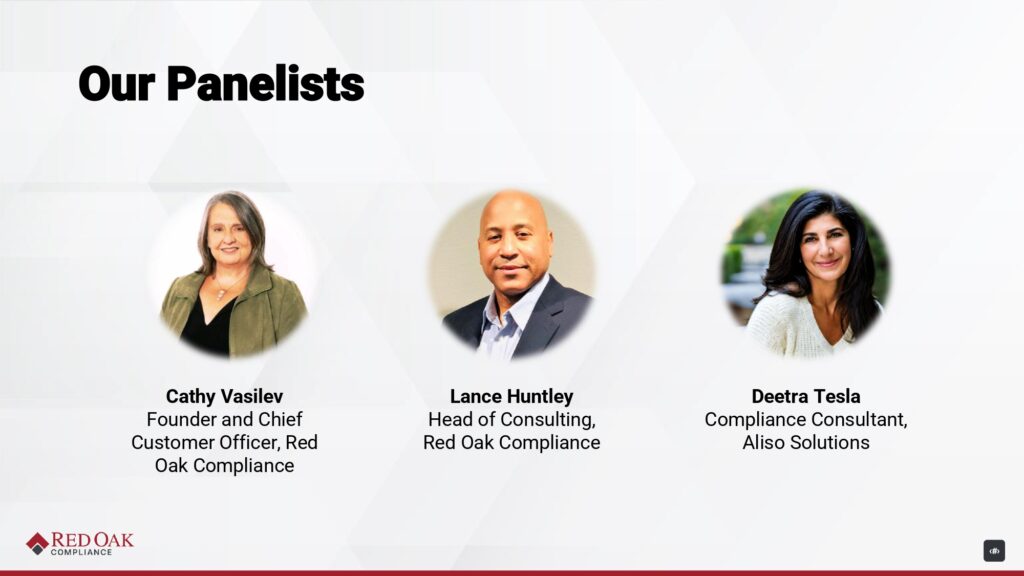

The speakers we have today—we’re thrilled to have Cathy Vasilev, our Founder and Chief Customer Officer at Red Oak. Most of you probably know Cathy, or have heard of her, or seen her at events. She’s been in the industry for more than 25 years and has a tremendous amount of experience.

Lance Huntley is our Head of Consulting at Red Oak Compliance. Lance also has a long career in the industry. He worked for FINRA in the 1990s and held Chief Compliance Officer positions at several broker-dealers up until 2018, at which point he joined Red Oak. We’re thrilled to have him—he’s got a lot of great insight.

And then we have Deetra Tesla. She is a compliance consultant with Aliso Solutions. She works with several clients. She’s going to talk about experiences from one of those. She also has many years in the industry and is currently the CCO for Augment as well as TCFG broker-dealer and investment advisor entities. So we’re thrilled to have everyone here, and I’m not going to take up any more time. We’re going to pivot over to the first section: RSLs, remote inspections, and FINRA.

We’re going to start this section with a quick poll. Pretty simple—just asking you how confident you are in navigating RSLs and remote inspections. So you just click the radio button, and we will have answers here. It takes us a few seconds, but this will be a good level setting on where we are as we move into this presentation.

Okay, interesting. Very interesting distribution. Clearly this will be a helpful session—with only 25% being confident, I’m pretty sure you’ll glean some additional information here. A lot of folks have a general idea, could use some help, or are not confident. Thanks for that feedback. At this point, I’m going to hand it over to Lance. Take it away.

Lance Huntley

All right. Thank you so much, Jamey, and thanks everyone for signing up for today’s webinar.

Deetra Tesla

Thanks.

Lance Huntley

We have a new year, so guess what? We’ve got new FINRA rules to talk about. The ones we’re going to be focusing on today, as Jamey mentioned, are 3110.19 and 3110.18. These rules came out in the middle of last year. FINRA always does a pretty good job of dripping information up to the effective dates of these rules.

The focus here is to permit firms to designate a private residence from which an associated person can engage in specific supervisory activities as a non-branch location, subject to certain safeguards and limitations. The notice also detailed that such a location will be designated as an RSL within the CRD system and be subject to inspection on a regular periodic basis instead of the typical annual inspections that we see for OSJ offices.

The RSL rule went into effect in June, and firms had to respond to an RSL questionnaire on Form U4 no later than December 26, 2023, for any locations they deemed should be designated as an RSL in the system.

There was also a pilot program that went into effect. We know some folks may have signed up for it. I was at some conferences last year taking informal polls, and some folks said they were going to take a wait-and-see approach—which is understandable. When I was a CCO, I typically took the same approach. That’s a three-year program. They’ll be gathering data, and we can expect they’ll compile that and build out a bank of questions as we all learn to live with these new requirements.

With that, I believe we have another poll question teed up: Have you opted into the remote audit pilot program? I think I know what the results will be, but I might be surprised. Let’s give that a minute to populate.

Cathy Vasilev

No.

Lance Huntley

Okay, by a pretty significant margin… oh, sorry, yes! Excuse me—54% said yes. Okay, I would’ve been in the “no” category, but hey—that’s good. That probably speaks to the amount of collaboration going on in the industry. I think it’s a good thing to have dialogue. In the past, it wasn’t quite that way.

On to the next slide. These are really six pillars or themes that FINRA is promoting:

- Balancing Modernization of Oversight – FINRA is recognizing the shift toward remote work and the need for flexibility in firms’ supervisory practices.

- Risk-Based Approach – Both RSLs and remote inspections require firms to adopt a risk-based model, tailoring decisions to the specific risks of each location.

- Robust Controls – The new framework needs to be built on strong internal controls.

- Technology as an Enabler – Firms should leverage tech for communication, recordkeeping, and surveillance to maintain compliance. Secure systems and data accessibility are critical.

- Investor Protection – Even with more flexibility, FINRA reiterates that these updates do not lower the bar for compliance.

- Ongoing Evaluation and Feedback – The pilot program will be closely monitored. FINRA is actively seeking feedback to assess and adjust the program.

Lastly, open communication is key. Proactively addressing these changes signals a forward-thinking approach. Since COVID, we’ve had to think about new ways to manage operations and monitor our registered reps in the field—and these new rules are just part of that reality.

Next slide, please.

Jamey Heinze

All right, thank you, Lance. That was a good baseline setting, and we’re now ready to jump into this a little more deeply. I’m going to pass the baton over to Cathy.

Cathy Vasilev

Thank you, Jamey. So what does this mean for your firm?

Anytime FINRA comes out with a new rule, there are both opportunities and challenges. It’s never just “we’re going to make your life easier.” It’s more like, “we’ll make it easier and challenge you at the same time.”

The Opportunities:

- Cost efficiency – You may save by not having to register these locations as full branch offices or conduct annual OSJ-style inspections.

- Adaptability – You get to decide whether to participate and who qualifies as an RSL.

- Operational modernization – This could be a catalyst to streamline internal operations.

The Challenges:

- You have to establish a new program, which means updating your supervisory procedures.

- You’ll likely need technological investment. Managing this manually, like in Excel, is not sustainable.

- Expect increased regulatory scrutiny—FINRA will be hyper-focused on these changes during exams, possibly even conducting sweeps.

- You might need to file a MAP amendment (Membership Agreement update), depending on how your firm is structured.

If you choose not to participate in the RSL program, you’ll just continue registering locations as OSJs, which could mean higher operational costs. But if you do participate and don’t comply properly, the risks include:

- Fines

- FINRA invalidating your RSLs

- Reputational risk

So if you’re going to do it—like with anything involving FINRA—take it seriously, get your compliance hat on, and do it the right way from day one.

One of the first questions we’ve received from firms is: “Does my CCO have to be registered from an RSL?”

Often, firms are getting feedback through the CRD system when someone is working from home. So now you need to go into the U4 and make that official RSL designation. There are a lot of nuances in figuring out who should and shouldn’t be designated.

Cathy Vasilev (continued)

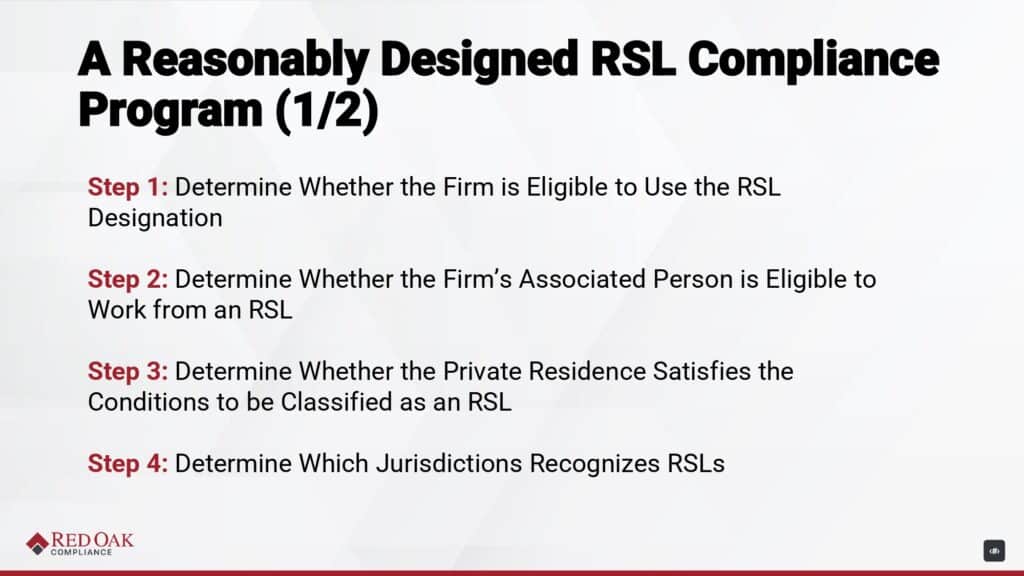

So what is a reasonably designed RSL compliance program?

We’ve outlined nine steps that help determine whether your firm has a sound, reasonably designed RSL program:

Step 1:

Determine if your firm is eligible to use the RSL designation. FINRA has several disqualifiers:

- Restricted under Rule 4111 (significant disciplinary history)

- Taping firm designation

- Suspended membership

- Less than 12 months as a broker-dealer

- Violation of Rule 3110(c) in the past 3 years (failure to properly conduct inspections)

- Subject to Rule 9557 restrictions

- Subject to Rule 1017 (MAP review)

Step 2:

Determine if the associated person is eligible. Disqualifiers include:

- Less than one year of direct supervisory experience

- Limited principal authority

- Under mandatory heightened supervision

- Statutory disqualification

- Subject to regulatory investigation (e.g., received an 8210 letter)

Step 3:

Confirm the private residence meets RSL conditions. Restrictions include:

- Only one associated person per location (unless they all live there)

- Cannot:

- Approve new accounts

- Review or endorse customer orders

- Approve retail communications (except research reports)

- Supervise activities at other branch or non-branch locations

Step 4:

Check state regulations.

Some jurisdictions do not recognize RSLs. If that applies, you must treat that location as a registered branch—no exceptions. CRD shows which states do not accept RSLs.

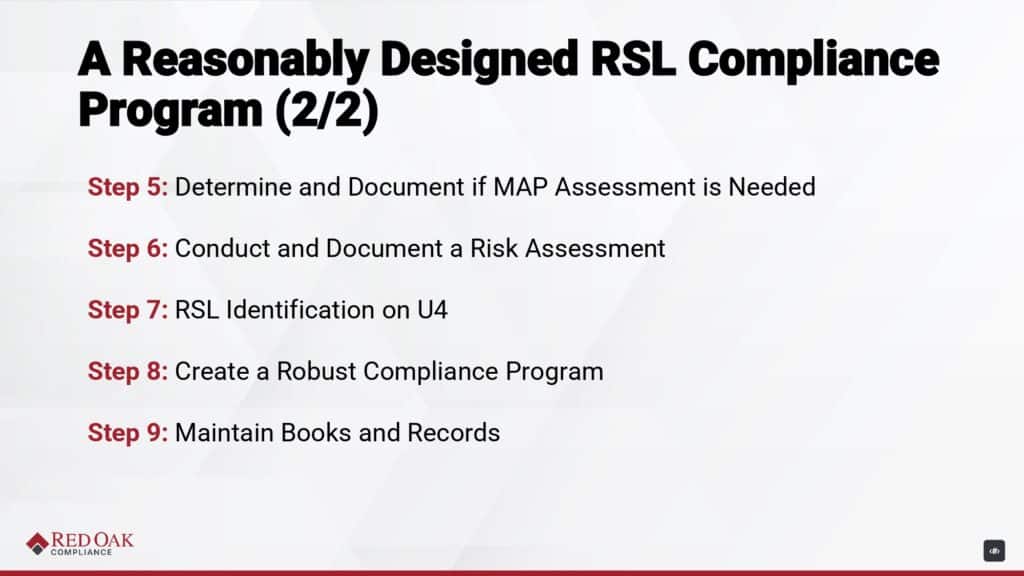

Step 5:

Perform a MAP assessment.

Check whether designating RSLs changes your business model enough to require a membership agreement amendment. You must:

- Document the assessment

- Keep it in your books and records

Step 6: Conduct and Document a Risk Assessment

FINRA expects a risk-based approach to determine whether a location and associated person should qualify as an RSL. Your firm must:

- Document red flags such as:

- Customer complaints

- Failure to follow policies

- Disciplinary history

- Recordkeeping violations

- Regulator communications or subpoenas

- Higher-risk activities (e.g., private placements)

- Determine mitigation plans if red flags exist

- Clearly show how decisions are made

- Include this documentation in your compliance files

Step 7: Update Form U4

Once your firm confirms RSL status for a person/location:

- Update Form U4 in the CRD system

- Select “Yes” or “No” for the RSL designation

- This is the official notification to FINRA

Step 8: Update Policies and Procedures

After going through steps 1–7, you must update your compliance program:

- Revise Written Supervisory Procedures (WSPs) to reflect:

- How RSLs are designated

- Inspection schedules and methods

- Recordkeeping standards

- Update branch inspection schedules to include RSLs

- Must occur every three years

- Must be on-site inspections, unless enrolled in the remote pilot

- Remote Inspection Pilot Program

- Opt-in deadlines:

- June 26, 2023 (last year)

- December 27, 2024 (this year)

- You can still opt in later during the 3-year pilot window

- Opt-in deadlines:

Step 9: Maintain Proper Books and Records

You must maintain documentation such as:

- Redlined versions of updated WSPs

- Risk assessments and MAP analysis

- Inspection schedules and outcomes

- Copies of CRD U4 filings

- Program eligibility checks

Jamey Heinze

Hey Cathy, I’m going to go against the process we set—we were going to save all Q&A—but one person, Lynn, asked about Step 3. Would you mind repeating that one?

Cathy Vasilev

Sure. For Step 3, it’s about confirming the private residence qualifies as an RSL. Key requirements:

- Only one associated person per RSL location unless they all live there

- Cannot:

- Approve new accounts

- Conduct principal review of orders

- Final approval of retail communications (except research reports)

- Supervise reps at other locations

Also, the firm must be eligible (e.g., not restricted under 4111, not new, etc.).

Deetra Tesla

Good morning, everybody. I’m Deetra with Aliso Solutions. As a compliance consultant and CCO for two firms, I want to share how we’re making remote supervision work through integrated technology.

At one firm, we manage 35 remote locations, including supervisory branches. The remote program is built on three core platforms:

- Docupace – Digital workflow for:

- Client forms

- Subscription agreements

- New account forms

- CRS delivery and verification

- E-signature support

- Ignite – Secure cloud storage (encrypted digital filing cabinet)

- Red Oak Compliance – Supervisory tools for:

- Marketing reviews

- Compliance docs

- WSPs and ADV access

- Reference library for field staff

Together, these systems create a fully cloud-based environment—no physical paperwork or storage in branches.

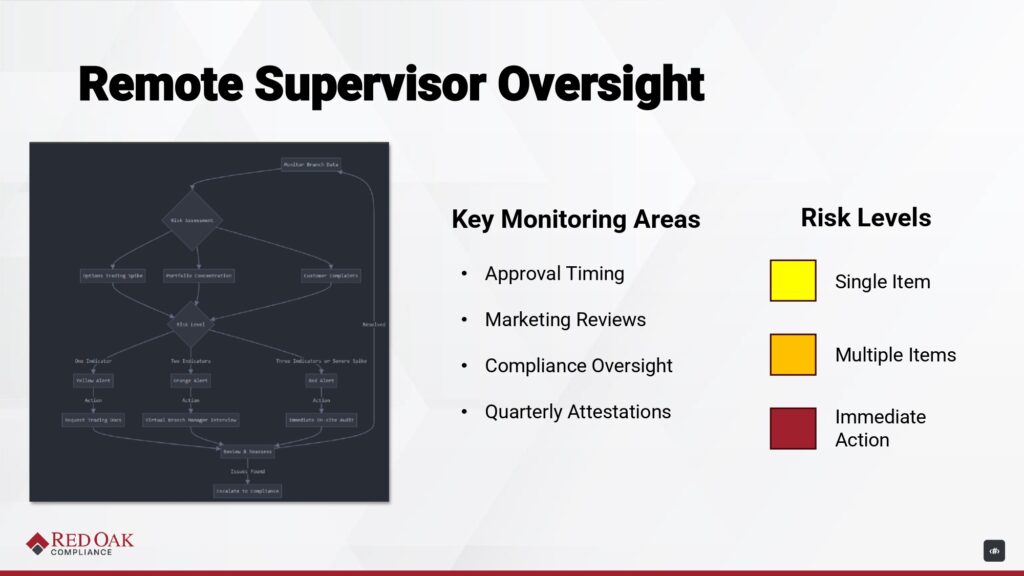

Technology-Driven Risk Monitoring

We monitor supervisors and reps using a central system and risk triggers:

- Triggers:

- Spike in options trading

- Portfolio concentration

- Customer complaints

- Alert levels:

- Yellow – 1 indicator → triggers document review

- Orange – 2 indicators → virtual interview with branch manager or rep

- Red – 3+ indicators or a severe spike → immediate onsite audit

This feeds into a branch monitoring system to create a continuous oversight loop.

Quarterly Reviews via Red Oak

We conduct reviews across six areas:

- Client fund handling

- Marketing approvals

- Correspondence review

- Direct business

- Outside business activities

- Gifts and entertainment logs

Supervisors complete attestations quarterly, confirming their ongoing oversight. Attestations cover:

- Receipt of checks and forwarding

- Marketing usage

- Direct business activity

- Recordkeeping compliance

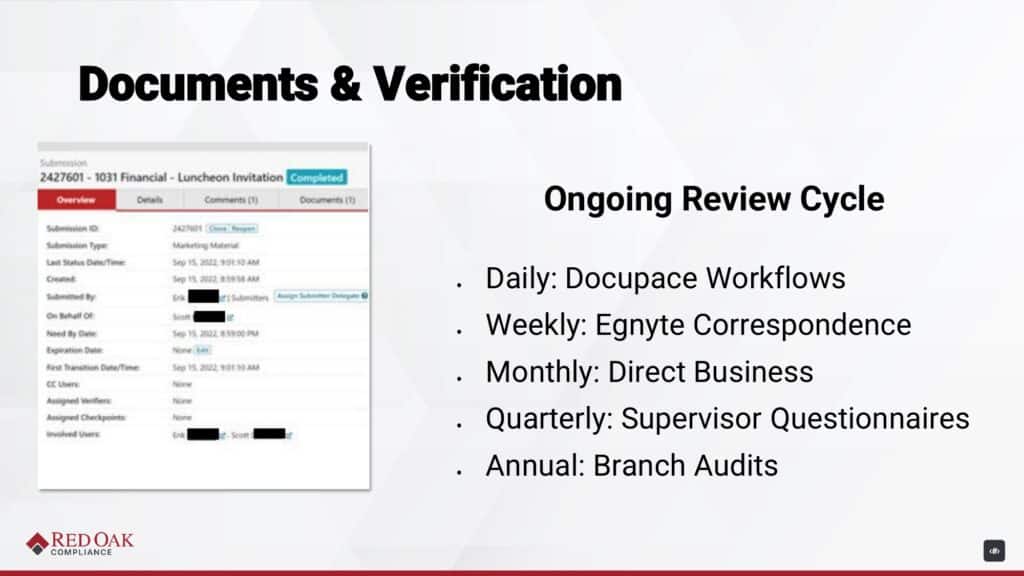

Audit Trail & Branch Exams

The system shows clear timestamps and accountability:

- E.g., a marketing piece submitted at 8:59 AM and required by 8:59 PM

- Everyone involved is clearly logged

- Full audit trail is maintained

Branch audits are streamlined:

- Most of the review is done before arriving onsite

- We pre-audit:

- Trading patterns

- Marketing materials

- Correspondence

- Attestation responses

This means in-person visits focus on interviewing reps and verifying findings, not paperwork.

Keys to Success

Five core pillars of the program:

- Integrated technology

- Clear documentation

- Regular attestations

- Systematic assessments

- Multiple verifications

This structure enables complete oversight in a remote supervision environment.

Jamey Heinze

Cathy, I’m going to break protocol and go back. Someone asked you to repeat Step 3 from earlier.

Cathy Vasilev

Sure. Step 3 relates to whether a private residence qualifies as an RSL. Here are the key points:

- Only one associated person can be assigned to an RSL unless multiple people live at the same location.

- The residence cannot be used for certain supervisory functions. Specifically, the following cannot be conducted at an RSL:

- Approval of new accounts

- Review and endorsement of customer orders

- Final approval of retail communications (except research reports)

- Supervision of persons at other branch or non-branch locations

If any of these functions are performed, the location does not qualify as an RSL.

Introducing the Guest Speaker

Jamey Heinze

Thanks, Cathy. Now, we’re moving into our next portion—introducing our guest speaker, Deetra Tesla—who has already shared a lot of great insights.

Lance Huntley

Thanks, Jamey. And thank you, Deetra, for highlighting how you’re using Red Oak’s tools. I’ll keep this brief.

At Red Oak, we offer several solutions designed to support firms with compliance in light of these RSL and remote inspection rules:

1. Branch Audit Module

- Fully books and records compliant

- Highly configurable for each firm’s workflows

- Built to accommodate a variety of firm structures

“We have one version of the software, but every firm is a snowflake—we configure it to fit your needs.”

2. Registration Management Platform

- Captures data from CRD as well as HR or commission systems

- Offers custom fields, reminders, and notifications

- Helps track non-CRD data in one system

3. Risk Assessments & Gap Analysis

- Workflows are available to support these assessments

- Help firms stay ahead of rule expectations

4. Consulting Services

- Our experienced compliance team can:

- Help develop policies

- Administer branch exams

- Support regulatory responses and filings

- Can also fill gaps during vacation or leave

Jamey Heinze

Perfect. We’ve got a long list of questions and enough time to go through many of them. Let’s jump in.

Q: Does the RSL program apply to RIAs or broker-dealers—or both?

Lance Huntley

These rules apply to broker-dealers only. If you’re a dual registrant (BD/IA), then the BD rules apply.

Q: What’s the latest on a permanent rule for remote inspections?

Cathy Vasilev

We’re in the three-year pilot program now. After that, FINRA will assess its effectiveness and determine permanent changes. So nothing final for at least three years.

Q: What qualifies as an RSL? What about hybrid workers?

Cathy Vasilev

The concept of “hybrid” has been removed. If you’re a supervisor working from home—even one day a week—you must designate the location either as an RSL or a registered branch.

Q: How are firms managing RSLs in states like Virginia that require in-person or annual inspections?

Cathy Vasilev

If a state does not recognize RSLs, you must follow the state’s rules. That means registering the location as a branch and conducting inspections as required.

Q: FINRA requires a supervisor physically located at the branch on Form BR. How is that handled for RSLs?

Cathy Vasilev

That’s specifically addressed in FINRA’s FAQs. Look there for direct guidance.

Q: If enrolled in the remote pilot program, can RSL inspections be virtual?

Cathy Vasilev

Yes, remote inspections are allowed only if you’ve opted into the pilot.

Q: Do these FINRA expectations apply to fee-based IARs?

Cathy Vasilev

No, this is strictly for broker-dealers. RIAs are exempt, unless you are dually registered, in which case the BD may impose related requirements on the RIA.

Q: Can RSLs approve final retail communications?

Cathy Vasilev

No. RSLs cannot approve final retail communications for use by others.

The only exception is for the approval of research reports.

Q: How do you handle states like Texas and Florida that do not accept the RSL designation?

Cathy Vasilev

Follow state law. If they don’t accept RSLs, register as a branch and don’t mark the location as an RSL on the Form U4.

Q: Can financial advisors be designated under RSL?

Cathy Vasilev

No. This is only for individuals performing supervisory functions from their homes—not for general financial advisors or registered reps.

Q: Is there a list of states that do not accept remote inspections?

Cathy Vasilev

I don’t have a full list of states rejecting remote inspections. That’s something we should consider compiling.

Q: Which FAQ specifically addresses the Form BR “physically located” comment?

Cathy Vasilev

We’ll look up the exact FAQ and provide it later. It’s covered in FINRA’s official FAQ list.

Jamey Heinze

That wraps up the Q&A—amazing participation. I think that’s the longest list of questions we’ve seen so far. We really appreciate the engagement from everyone.

And if you have more questions after this session, feel free to reach out to Lance, Cathy, or Deetra—they are available and happy to help.

Their email addresses and a QR code contact form are available on the slide.

Upcoming Webinars

We’re continuing our webinar series.

Next Topic:

“Mastering the Supervision of Your Registered Representatives’ Online Presence”

🗓️ Coming in March

It’s a long title but a critical subject. Please go ahead and register for that event when it’s available. We’ll have more guest speakers and new insights to share.

Red Oak User Conference

Also, don’t forget our Annual Red Oak User Conference happening in April in Austin, Texas.

It’s going to be a big one.

- Tons of valuable sessions

- Networking opportunities

- Everything available via the QR code or on our website

Past Webinars

This is the third webinar in our ongoing series.

If you missed the earlier ones, they’re all available online to watch at your convenience.

Jamey Heinze

Thanks again to everyone who logged in today.

And a special thanks to our amazing speakers—Cathy, Lance, and Deetra—for sharing their expertise. I definitely learned a lot today.

Have a great rest of your day, everyone!